Deadline Looming for Tax Curbing Initiative

A NJ lawmaker is pushing for a bill that would make the 2 percent cap on interest arbitration on contract talks with public employees a permanent mandate. If the law passes, the cap could help towns stabilize property taxes, according to the legislator.

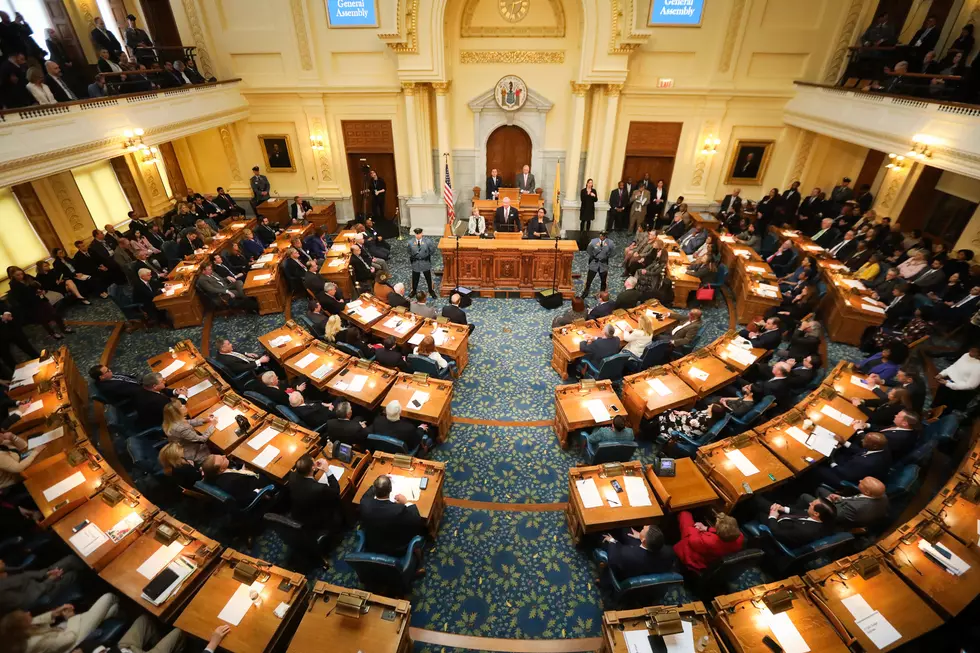

In 2011, New Jersey enacted a 2 percent cap on property tax increases. The state also mandated a 2 percent cap on interest arbitration in contracts talk with public employees including police and firefighters. The property tax cap is permanent, but the arbitration cap is set to expire April 1. A bill has been drafted to make the arbitration cap live on in perpetuity.

“I’m introducing legislation that will make the cap on interest arbitration awards that we did four years ago permanent,” said Assemblyman Declan O’Scanlon (R-Red Bank). “It has to be permanent. If we are going to hold the line on property taxes and if we are going to not bankrupt municipalities this has to be made permanent.”

According to O’Scanlon the arbitration cap is one of the key reforms the legislature and Gov. Chris Christie have been able to push through. He said the cap has been instrumental in helping towns stabilize property taxes.

“We have seen this year the lowest growth in property taxes in 15 years and we will continue to see that if we continue this policy,” O’Scanlon said. “Mathematically you can’t have a tax cap without an arbitration award cap. It would be like me saying to you, ‘I’m going to limit your salary increases every year in your household to two percent, but I’m going to increase you mortgage payments by 10 percent.'”

Anyone who is against the interest arbitration cap is, by definition, against the property tax cap according to the assemblyman.

More From WPG Talk Radio 95.5 FM