Jersey Jackpot: Treasurer Raises Revenue Outlook Over $5 Billion

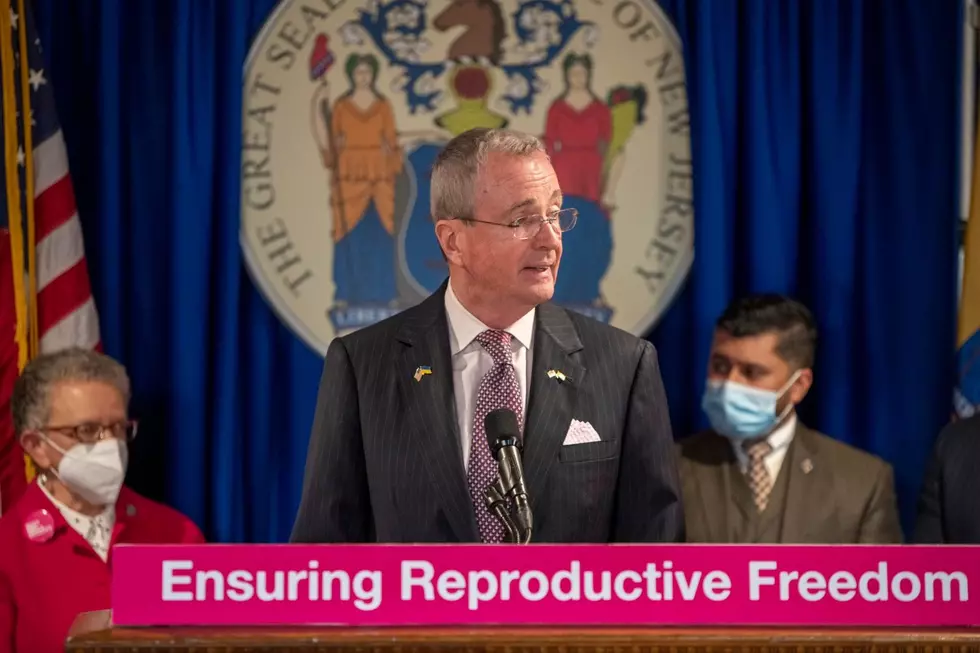

TRENTON – State revenues are now expected to surge to all-time highs, far exceeding any previous forecasts, staking the state government to an unprecedented surplus topping $10 billion to close out the current fiscal year this month.

Both the Department of the Treasury and nonpartisan Office of Legislative Services agree there will be a deluge of tax collections, though the details aren’t exactly identical. Compared to its February report, the Treasury is raising its forecast by $4 billion for this year and $1.1 billion for next year.

The Murphy administration projects this year’s revenues will approach $44 billion, not including the nearly $4.3 billion in proceeds from COVID-19 bonds sold when the state thought the pandemic would gut revenues. In fiscal 2019, the last year before the pandemic began, revenues were $38.3 billion.

The Treasury Department says spending in the current budget has been adjusted to $41.6 billion, up $379 million since February. Spending in the proposed 2022 state budget is now just under $45 billion, up $130 million since February.

The $10.1 billion surplus projected for June 30, combining the regular fund balance and the so-called ‘rainy day fund’ for surplus revenue, is $3.765 billion higher than the February estimate. The combined surplus is forecast to be over $6.9 billion in June 2022, up $4.74 billion from the February outlook.

Unlike in February, the Murphy administration now recommends keeping the surplus revenues in the ‘rainy day fund,’ rather than transfer them to balance the 2022 budget.

State Treasurer Elizabeth Maher Muoio had been scheduled to update the revenue forecast before the Assembly Budget Committee on Wednesday, but the meeting was scrapped without explanation. She released the update and her written testimony instead.

“Thanks to a remarkable two-month revenue collection surge – an April and May ‘surprise’ like no other – state tax collections in Fiscal Year 2021 (FY21) are hitting historic highs,” Muoio said.

Muoio said projections for income, sales and corporate taxes “have jumped past” pre-pandemic levels a year sooner than had been expected. She said a report by the Pew Charitable Trusts finds 29 states had already recovered their pandemic revenue losses even before the spring tax filing season.

Muoio credits federal stimulus packages approved by Congress in December and March, the speed of vaccine development and distribution and soaring stock market.

Assembly Republicans said it appears that spending in fiscal 2022 is more than $3 billion above the expected recurring revenue, raising the prospect of a deficit that will need to be addressed in fiscal 2023. They said in a letter to Muoio and Gov. Phil Murphy that they “cannot fathom what you are trying to hide” by not returning to the budget committees to update revenues.

“There are only two possibilities that come to mind: that your administration is woefully unprepared to explain how you plan to spend the newly expected money and the more than $6 billion in federal aid, or your disdain for transparency and the legislative process satiates your hunger for unilateral power,” they wrote.

On top of the increased revenues, the state also has received $6.2 billion from the most recent coronavirus recovery package to spend over the next few years.

Sen. Steve Oroho, R-Sussex, said the Legislature should form a special committee with subpoena power to investigate why the state sold $3.67 billion in COVID emergency bonds. He said the borrowing was unnecessary and that the administration “misled lawmakers, the court and taxpayers.”

Why you shouldn't visit the Jersey Shore this summer

NJ's most and least COVID vaccinated towns, by county

More From WPG Talk Radio 95.5 FM