Legislature Sends Murphy a $38.7B Budget — What Will He Do With It?

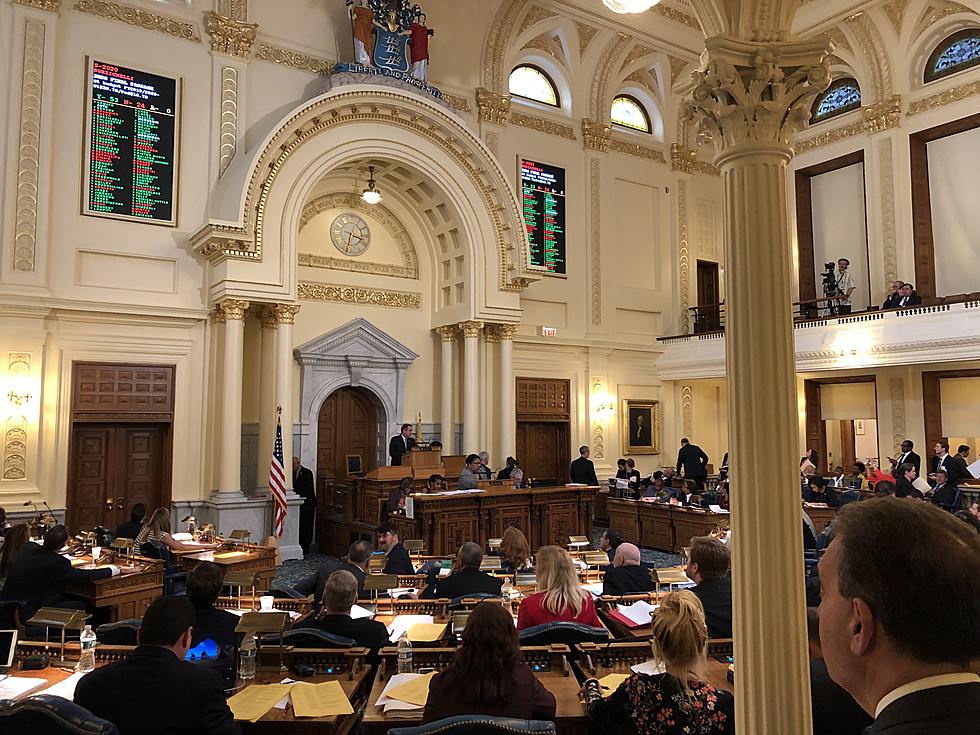

TRENTON — Lawmakers approved a $38.7 billion state budget for the 2020 fiscal year Thursday, as expected. What happens next remains a mystery.

Gov. Phil Murphy has criticized the budget written by Democratic lawmakers, in part for its spending changes but mostly because of its revenues – both the absence of a millionaires’ tax and the inclusion of $275 million in tax collections he doesn’t expect to materialize.

Murphy could sign the budget as is, which seems highly unlikely.

He could veto it entirely, sending it back to the Legislature.

He could use his line-item veto power to erase spending items and reduce tax forecasts.

Or he could negotiate with legislative leaders to find a middle ground by June 30.

“I’m happy with the product we have produced today. I look forward to the governor signing the budget,” said Assembly Speaker Craig Coughlin, D-Middlesex. “I think when he gets a look at it, he will understand that this is a quality budget that advanced the cause in a good way for the people of New Jersey.”

Senate President Steve Sweeney, D-Gloucester, said “it’s a very strong budget … and there’s really no reason to line-item anything.”

“Hopefully next week we’ll hear and, you know, there might be some things he’d like to see in the budget that weren’t in the budget. And we might be able to have a conversation on things that he might think about line-iteming,” Sweeney said. “You’ve got 10 days. But one thing I do know: We gave him a very good budget that met the needs, a lot of really priority needs in this state, without raising taxes.”

Murphy is expected to address the budget at a 12:30 p.m. Friday news conference, which his office describes as being about “tax fairness and fiscal responsibility.”

Murphy uses the phrase “tax fairness” to describe his push to increase the tax rate on income over $1 million from 8.97 percent to 10.75 percent, which is the rate applied since last year to income over $5 million.

Though it wasn’t in the budget, the millionaires’ tax was discussed favorably during the Senate floor debate by state Sens. Dick Codey and Nia Gill, both D-Essex. Codey voted for the budget, anyway, but Gill didn’t cast a vote.

“This budget, to the extent that it does, represents more of a trickle-down economic theory than a progressive forward for the middle class and the people and the citizens of our state,” Gill said.

Sweeney said higher taxes can be considered as part of a bigger solution of the state’s finances, if it’s part of a plan that also reduces the state’s pension and health benefits liabilities for public workers.

“All we hear about is a millionaires’ tax as (if) that is the panacea that is going to fix New Jersey,” Sweeney said. “When do we stop ignoring a $230 billion deficit that we have right now. New Jersey is in a financial death spiral.”

“We need to change what we’re doing in this state. It’s getting worse,” Sweeney said.

Seven Republicans voted for the budget in the Senate, where it passed 31-6: Christopher "Kip" Bateman, of Somerset County; Kristin Corrado, of Passaic County; Tom Kean Jr., of Union County; Declan O’Scanlon, of Monmouth County; Joseph Pennacchio, of Morris County; Robert Singer, of Ocean County; and Sam Thompson, of Middlesex County.

No Republicans voted for the budget in the Assembly, where it passed 53-21-1. The 53 votes for the budget are one short of the number needed to override a veto, but one Democrat was absent, Gabriela Mosquera, who is on maternity leave but would presumably be available if it comes to an override bid.

Assembly Minority Leader Jon Bramnick, R-Union, said the budget includes a lot of spending on programs that are tempting to support, such as an extra $75 million for NJ Transit, but that it fails to address the state’s structural problems.

“And that’s why you saw all ‘no’ votes from the Republican caucus,” he said. “It’s not because we don’t want to fix New Jersey Transit. We want to fix the state of New Jersey as well as New Jersey Transit.”

More From WPG Talk Radio 95.5 FM