Gloucester City, NJ, Business Owner Admits Payroll Tax, Pandemic Loan Fraud

Federal authorities say the owner of a business in Gloucester City has admitted failing to pay payroll taxes to the IRS, failing to file personal income tax returns, and fraudulently obtaining a Paycheck Protection Program (PPP) loan.

69-year-old John Degan of Philadelphia pleaded guilty in Camden federal court on Thursday, according to U.S. Attorney Philip Sellinger's office.

Officials say Degan was the owner and operator of a building maintenance and restoration service company in Gloucester City that generated over $1.4 million in gross receipts yearly.

Degan admitted that for tax years 2016 through 2020, he willfully failed to file payroll tax returns and failed to pay over $600,629 in withheld employment taxes on behalf of his employees. Degan attempted to conceal from the IRS over $4.4 million in wages that he paid to himself and his employees by not filing and submitting Forms W-2 or Form W-3 to the Social Security Administration (SSA).

Degan, with a $140,000 to $170,000 annual salary, also admitted to not filing federal income tax returns for tax years 2016 through 2020 and has not filed a tax return since 2003.

Sellinger's office also says he did not file corporate tax returns for his business and, additionally, submitted a fraudulent application to obtain a PPP loan.

Based on his misrepresentations, he received $193,407 in federal COVID-19 emergency relief funds.

Potential penalties

- The charge of failing to collect, account for, and pay over payroll taxes carries a maximum penalty of five years in prison and a fine of $250,000, or twice the gross gain or loss from the offense, whichever is greatest.

- The charge of failing to file income tax returns with the IRS carries a maximum penalty of one year in prison and a fine of $100,000, or twice the gross gain or loss from the offense, whichever is greatest.

- The bank fraud count carries a maximum penalty of 30 years in prison and a fine of $1 million.

As part of his guilty plea, Degan agreed to make restitution to the IRS in the full amount of the taxes that he owes, and he agreed to make restitution to the lender in the full amount of the PPP loan.

Sentencing is scheduled for February 14th.

Great New Jersey Stores That We Once Loved That Are Now Closed

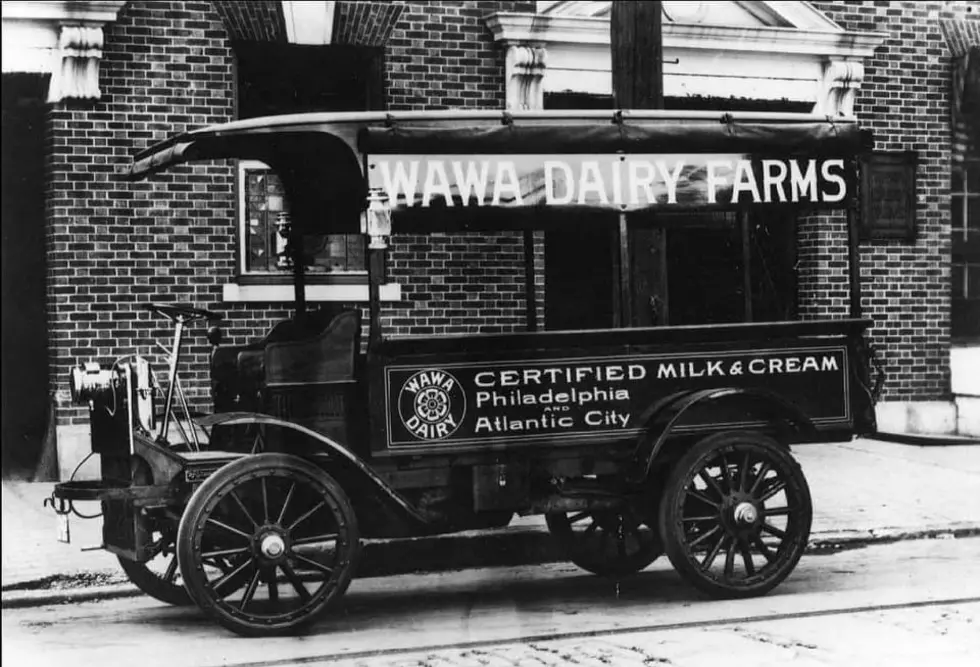

Vintage Wawa: A Look Back to the First Store & More

More From WPG Talk Radio 95.5 FM