Sanders Sides With Trump; Says People Who Pay $10,000 in Local Taxes are Rich

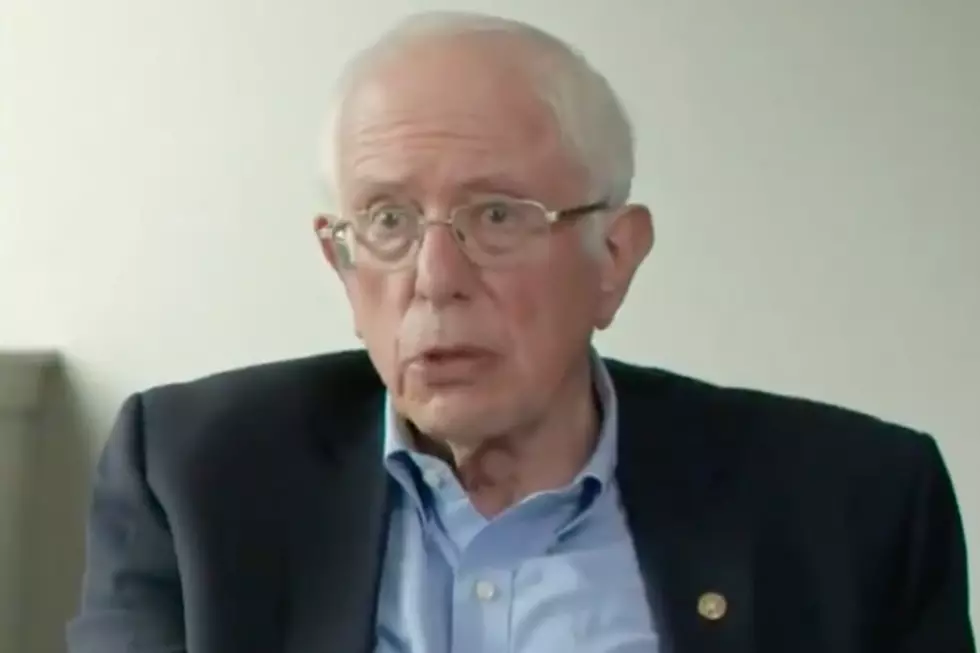

There’s at least one thing that U.S. Sen. Bernie Sanders apparently sides with former President Donald Trump on — keeping a limit on state and local tax deductions.

The SALT deduction allows taxpayers to deduct local tax payments on federal tax returns. It was capped at $10,000 under Trump's tax cut law in 2017.

Sanders appears to think the cap benefited the rich. But in New Jersey, where the average property tax bill is now $9,111 — the cap affects many middle-class homeowners.

Since the 2017 change, New Jersey taxpayers are paying $3 billion more in additional federal taxes, according to a joint letter sent by Gov. Phil Murphy along with the governors of New York, California, Connecticut, Hawaii, Illinois and Oregon.

"We were crushed by the SALT cap. I think it was completely political by the last federal administration I'm very happy that Secretary of the Treasury, Janet Yellen, has expressed broad sympathy and support for addressing that," Murphy said when asked about the issue during a state briefing on March 31.

Reinstating no limits on SALT deductions would provide New Jersey families with real tax cuts as the state has been walloped financially by the coronavirus pandemic, U.S. Rep. Josh Gottheimer, D-N.J. 5th District, has said since last spring.

Calling SALT "a tax break for rich people in blue states," Axios reporter Jonathan Swan asked Sanders about whether he thought it would be bad for President Joe Biden's administration to roll back the cap.

"It sends a terrible, terrible message," the Democrat from Vermont said. "In fairness to [Senate Majority Leader Chuck] Schumer and [House Speaker Nancy] Pelosi, it is hard when you have tiny margins."

"But, you can't be on the side of the wealthy and the powerful if you're gonna really fight for working families,” Sanders added.

In New Jersey, SALT impacted well more than the wealthiest households, according to federal data.

About 40% of the state’s tax filers used the deduction before it was capped, with the average write-off topping $17,000 according to Smart Asset.

Even Sanders’ home state was among the top 10 states with the highest average SALT deduction, as 27% of returns took SALT deductions, of an average close to $12,000, according to the same analysis.

The average deduction before the SALT cap was above $10,000 in 20 of the state’s 21 counties, as reported by NJ Spotlight.

In years past, New Jersey was among just six states (along with New York, California, Illinois, Texas, and Pennsylvania) that claimed more than half (51.6%) of the value of all SALT deductions nationwide, according to an Oct. 2018 blog by The Tax Foundation, an independent tax policy non-profit.

U.S. Rep. Bill Pascrell, D-N.J. 9th District, previously has said nearly two-thirds of New Jersey households earning between $75,000 and $100,000 used the SALT deduction in 2017, and the average deduction was around $19,000.

LOOK: Here Are 30 Foods That Are Poisonous to Dogs

0

NJ towns that actually cut property taxes in 2020

Famous NJ people from A to Z (almost)

More From WPG Talk Radio 95.5 FM